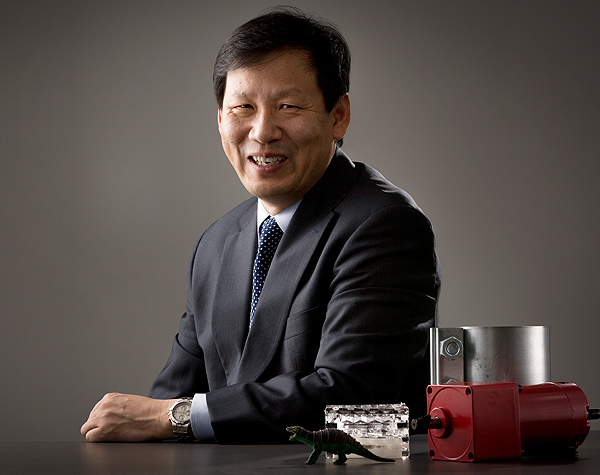

“Ray took us through it every step of the way,” says Sterling. “He sent prototypes to China, and early samples were sent back and forth, each time tweaked.” Product development was bird-dogged by Jenny Xu, the Sun employee in Shanghai assigned to the project for a year. Sterling and Brewer paid for the samples and air-courier charges, while Sun covered Xu’s salary and travel expenses. If the goods came to market, he would get a percentage of sales.

But even Advantage China can get burned occasionally. Round magnets designed to hold up the locker “wallpaper” quickly fell down. The cost of the rare-earth alloys from which the magnets are made had skyrocketed in price that year, and the supplier waited until the last minute to secure enough of the expensive elements. Realizing he could no longer profitably deliver magnets made to promised specs, the supplier substituted 20,000 weaker ones. Not only did the company refuse to give a refund, but Sun had to find a new supplier and pay a lot more the second time around. Now, whatever the size of the shipment, Sun insists on complete article inspections: “Goods must be perfect before shipped.”

Scarce Necessities

The offspring of the despised capitalist middle class, Sun was a teenager in Shanghai during the Cultural Revolution of Mao Zedong, then chairman of the Chinese Communist Party. Sun spent years memorizing Maoist slogans in school and says, “For 10 years, I learned nothing.”

He considered himself lucky to own the officially approved biography of Gen. Georgy Zhukov, a Soviet hero of World War II, at a time of heightened political conformity, when most Chinese were deprived of Western literature (deemed “poisoned books”). And, even the most basic necessities were scarce. Sun’s three-generation family of six shared a single bicycle.

As a boy, Sun knew that his mother came from a privileged class, that her father had owned a fruit-canning factory before the Chinese Revolution. But only later did he and his two sisters discover that their father’s family too had been wealthy, owning land and buildings. Shocked and angry over being kept in the dark, Sun and his siblings confronted their mother, who defended herself by declaring, “Your Daddy never told me, either!”

Such were the times that a bourgeois heritage could deprive one of a school admission, a job, or a promotion. Even so, Sun managed to get a grounding in computers at a Shanghai university. He landed an IT job with the Shanghai center for disease control, where he met his future wife, Cecilier Chen Hua, a young doctor.

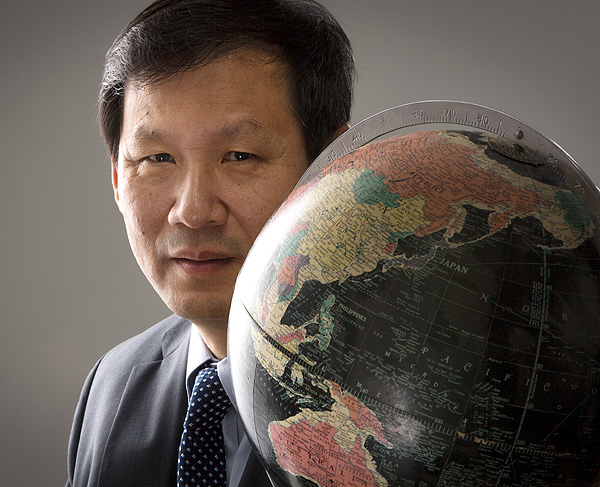

The 1989 pro-democracy protests and brutal crackdown in Beijing’s Tiananmen Square occurred just as Sun and his wife were waiting for passports. His wife had just snagged a research fellowship in France, and Sun had won admission to McGill University in Montreal for graduate studies in medical statistics. In those tense days, passports could not be issued without final approval from superiors who had to vouch that the applicants were not dissidents. Sun says he had long been used to keeping his personal beliefs to himself.

After McGill, Sun worked four years at Bell Sigma, then a year at IBM, then a year at the Bank of Montreal. The entrepreneurial bug had bitten and, along with a fellow Chinese immigrant partner, he formed a software business. But neither Sun nor his partner could grasp the fundamentals of dealing with investors—even those willing to invest $1 million, as did a group from Silicon Valley—so new were they to the capitalist West. It was an expensive lesson for both partners. With $100,000 he managed to salvage, Sun would later launch Advantage China.

Recently the company has faced a new challenge: the slowing Chinese industrial economy. Warehouses there have been packed with unsold goods. Low-end manufacturing has been lost to Vietnam and Bangladesh. Some high-end fabricating has even repatriated to the United States as the wage gap began to narrow and shipping costs rose. Wages in China have soared in heavily industrialized regions. The most striking examples were Sichuan’s 2012 minimum wage, which rose by 23 percent, and Shenzhen’s announcing a 16 percent increase on the 2012 minimum wage, following a 20 percent hike in 2011. Meantime, an analysis by InterChina Consulting predicts that China will likely lose its cost advantage sometime between 2015 and 2020 to low-wage countries with similar supply chains, such as Mexico and the CzechRepublic.

Despite all the “bad” news, Sun remains sanguine, confident that the negative trends will fall hardest on price-sensitive retailers like Wal-Mart, which he urges his clients to avoid. He believes his niche—small- and medium-sized production runs with quick turnarounds—will keep Advantage China growing.

“I now have a track record,” he says, referring to a certain alchemy that has, with the help of his Chinese connections, turned a number of entrepreneurial dreams into reality—including Ray Sun’s own. Today he owns a Lexus and a mortgage-free, 4,000-square-foot house in Plano and, earlier this year, he watched his only child graduate from Harvard.